The National Flood Insurance Program (NFIP) recently celebrated its 50th anniversary. On August 1, 1968, Congress enacted the National Flood Insurance Act of 1968 after the devastating effects of Hurricane Betsy in 1965. The NFIP was created to provide

an insurance alternative to disaster assistance. According to the Federal Emergency Management Agency (FEMA) "the program has aimed to reduce the impact of flooding on private and public structures by providing affordable insurance to property owners,

renters, and businesses, as well as by encouraging communities to adopt and enforce floodplain management regulations."

It All Started with an Ad in the Paper

When the program first started under the Department of Housing and Urban Development, before FEMA was formed, an ad was placed in a newspaper looking for help to prepare flood maps. We were awarded the contract and continuously supported the program since

then. The relationship built between FEMA and Dewberry has provided us opportunities to work with FEMA and other state and local agencies on large-scale projects. We've conducted a sea level rise study for North Carolina,

which led to the opportunity to work with the City of Virginia Beach on a sea level rise study. We're currently working as a subconsultant

to perform comprehensive data analytics, including flood hazard and property loss modeling and damage estimation, to support the City of Houston's post-Hurricane

Harvey recovery efforts.

The City of Virginia Beach is currently conducting a sea level rise study and flood analysis to be better prepared for flooding.

More than an Insurance Program

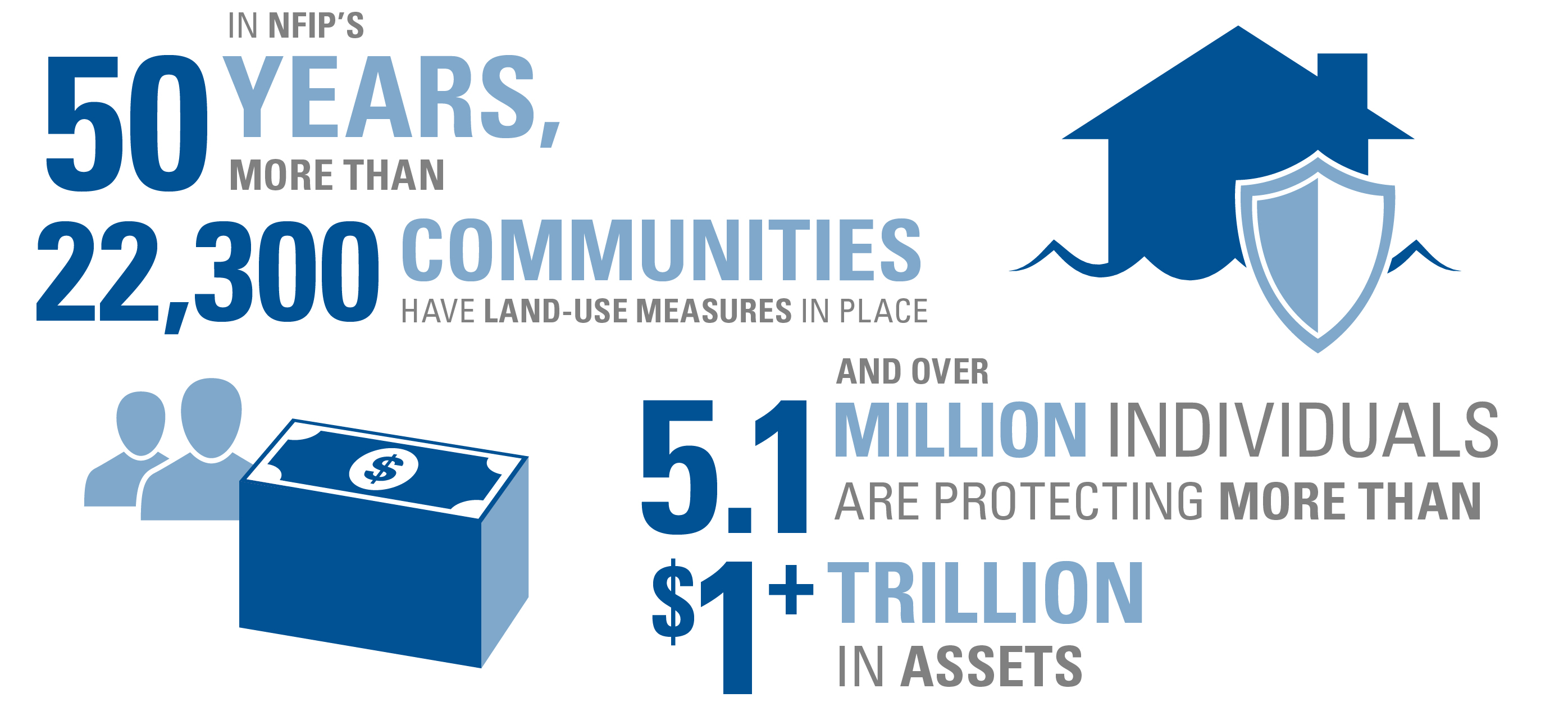

The NFIP is more than an insurance program, it has helped countless communities develop floodplain regulations and implement a floodplain management program. The program helps people avoid building in risky and flood-prone areas, which decreases the number

of flood losses. In my experience, the people working with the NFIP are passionate about flood risk and mitigation. Within its 50 years, more than 22,300 communities have land-use measures in place and over 5.1 million individuals are protecting more

than $1.29 trillion in assets.

Major Changes in Technology

The advancement of technology has played a major role in how the program has changed over the last 50 years. Manual cartographics were originally used to map the floodplains, however we are now using high-resolution data using lidar GIS data for sophisticated

engineering modeling and mapping. The advancement of the hardware and software capabilities has allowed us to create more accurate models at an increased speed.

With all of these advancements, it's possible to now show risk as well as hazards with the maps. Before the map was our end goal, but now the focus has shifted to using the underlying data we collect and produce. This new data provides the ability to

create a number of different products instead of just the map, which can provide information for other stakeholders, like private insurance companies and city officials. The new technology has allowed us to have a more agile setup where we deliver

the maps and information quickly and efficiently. For the last 50 years, the NFIP has been crucial for creating resilient communities and limiting catastrophic flooding.

NFIP Moving Forward

FEMA released its five-year strategic plan earlier this year and one of the goals in the plan is to "build a culture of preparedness." Two objectives within the goal are to incentivize mitigation investments to reduce risk and disaster costs,and to close

the insurance gap. FEMA's goal for closing the insurance gap is to have more people purchase flood insurance than currently do. The data and flood mapping the NFIP produces are foundational elements for

FEMA to achieve this goal and these objectives.