In 2015, a Dewberry team of engineers, planners, and geospatial analysts developed a tool to aid communities, state and federal agencies, and insurance companies in assessing wildfire risk. The Wildfire Risk Model is a geographic information system (GIS)-based tool that incorporates dozens of layers of geospatial information to evaluate wildfire risk at a 30-meter resolution. With its ability to assess risk at the address-level rather than the standard, less reliable zipcode-based analyses, our tool has become available at a critical time.

Sparking Concern

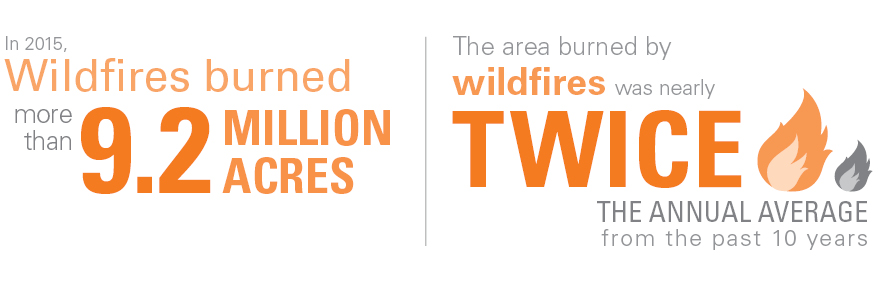

We’re at a moment in history when climate change, the urbanization of forested areas, and the dwindling of state and federal budgets have culminated into a perfect storm for increased risk of wildfire-related damage. In addition to human life and property losses, catastrophic wildfires threaten infrastructure, power grids, drinking water supplies, wildlife habitat, air quality, soil conditions, and watershed health. The increase in frequency and magnitude of these fires is unprecedented. In the last 10 years alone we have seen a major uptick in the voracity and frequency of these fires with the burn area of wildfires in 2015 nearly double the annual average and the number of megafires, fires that burn more than 100,000 acres, reaching its highest rate of 18 total in 2015. To put this into perspective, before 1995, there was less than one megafire per year on average, whereas in the last 10 years there were an average of 10 per year.

Who Pays the Bill?

While the American taxpayer bears the brunt of firefighting costs, insurers are responsible for the insured losses, as there’s no federal fire insurance program similar to the National Flood Insurance Program. The insured losses estimate from the Valley and Butte fires in California is in excess of $1 billion, while those associated with the Waldo Canyon and Black Forest fires in Colorado are more than $750 million. As fires grow larger and more frequent, it’s important to understand how mitigation can provide savings as well as security from financial and land-use planning perspectives.

Our Solution

At a time when wildfire risk has reached an all-time high, we’ve teamed with Myriad Development to provide our clients with the resources they need to prepare for this threat. The Wildfire Risk Model assesses a broad range of elements, including fuel, weather, slope, wind patterns, and fire history, to determine property risk. This model can be used by insurers to determine which properties to inspect and for underwriting.

We hope that by creating the Wildfire Risk Model, more communities, state and federal agencies, and insurance companies will become aware of their risk level and take proper precautions. By mitigating their risk, our clients will be able to decrease wildfire impacts during this critical time.