Since last summer, when the National Flood Insurance Program (NFIP) Reform Act (also known as Biggert-Waters 12 or BW-12) was enacted by Congress on July 6, 2012, stakeholders and administrators of the NFIP have been identifying and assessing the impacts BW-12 may have. While BW-12 affects multiple aspects of the NFIP, the primary focus has been on exactly how flood insurance premiums paid by policy holders will change.

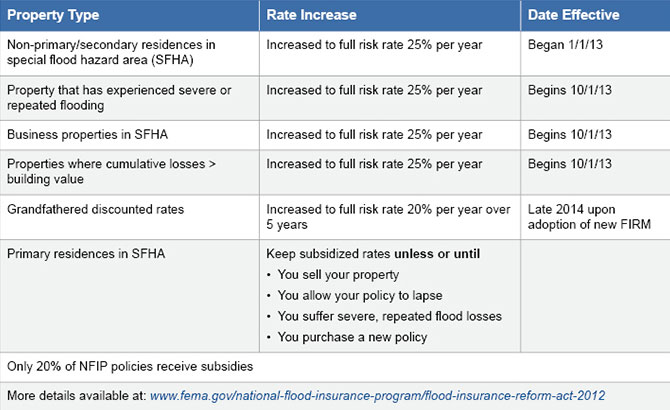

FEMA has done an excellent job communicating the long-range benefits of BW-12—resiliency in our communities and reduced flood risk—and how subsidized flood insurance rates (for homes built before Flood Insurance Rate Maps or FIRMs were adopted) are being phased upward to full actuarial rates, based on actual flood risk. Roughly 20 percent of flood insurance policies nationwide (over one million policies) have been subsidized prior to BW-12 implementation (see FEMA's resources on the Flood Insurance Reform Act).

Changing the Equation for Communities

While it's clear what actuarial flood insurance rates will apply in certain scenarios, it's yet to be seen how the changes may impact specific communities and properties. Beyond any political issues, many are wondering what cascading effects BW-12 may have on communities socio-economically. With second home subsidies already being phased out, for example, it would seem that some long-established coastal vacation communities could have a high concentration of properties experiencing significant premium increases, particularly in conjunction with new storm surge studies leading to sometimes higher base flood elevations (BFEs) on FIRMs in the near future.

If premiums in these communities increased significantly, could the local economy have a short-term impact? Communities may also see changes to real estate values, particularly when the value is based on cash flow considerations of rental income covering mortgages plus insurance costs. A community that has been less affected by coastal storm surge or that has proactively adapted to mitigate BW-12 may experience an up-tick in vacationers who are looking for a better value for their vacation dollar.

In other cases, when in the past mitigation was performed commensurate with perceived risk, which many studies have shown to be much lower than actual flood risk; property owners may now be financially motivated to perform mitigation on their own, as the ten year ROI will prove positive compared to paying much higher flood insurance. In areas where property owners don't have the means to do so, will communities see a shift to more investor-owned rental properties that choose to live with flood risk and forgo insurance, since many investors pay cash?

These are just a few questions that have been raised so far in projecting BW-12 impacts within local communities. While it's clear that the potential ripple effects are many, communities that are taking proactive steps to inform their constituencies will likely experience more positive outcomes from BW-12. It's also clear that BW-12 is a necessary and positive step for the country in making the NFIP more financially stable; and while there may be short-term challenges, in the long run the net effect should be reduced flood risk and increased resilience.