The Federal Emergency Management Agency's (FEMA) Risk Mapping, Assessment, and Planning (Risk MAP) program is providing communities with non-regulatory products that make flood risk management a little more understandable, and a lot more personal.

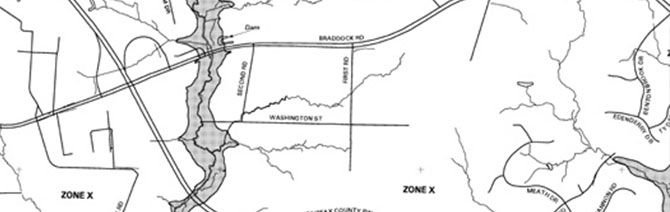

An example of a typical regulatory map for a portion of Fairfax, Virginia.

Regulatory Flood Risk Information

Flood risk information now comes in two types: regulatory, or what we like to call "one-dimensional," and non-regulatory. Simple and straightforward, regulatory maps are used by insurance companies to identify areas that are at risk for flooding, and so require flood insurance to cover federally backed mortgages. Whoever owns property inside the dark grey overlays in the above photo may be required to either pay for flood insurance, or prove they don't need it. These regulatory maps, often no more than lines and shading, aren't effective in communicating how high the water could be or the annual flood risk.

The limited amount of information shown on regulatory maps makes communicating the risks of flooding to developers, home buyers, and property owners quite a challenge. It takes a true professional to translate, much less communicate, the information presented in a regulatory map.

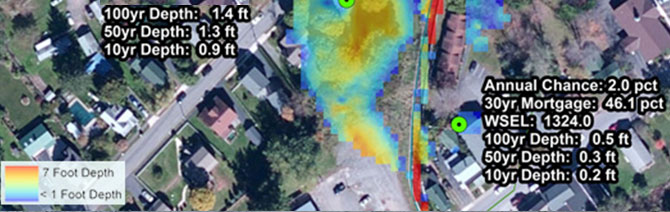

An example of non-regulatory risk map data for a New York neighborhood.

Non-Regulatory Flood Risk Information

Imagine a developer making the decision to build a subdivision a half-acre to the west of a risk area, limiting flood risk for future homeowners. Imagine communities who retrofit their homes by elevating them a foot above the two foot flood risk mark. Imagine how much safer a family can make themselves when they realize their three percent annual flood risk culminates to 90 percent by the end of their 30-year mortgage. All this information is used to create the regulatory maps, but is actually presented in the non-regulatory products.

Annual flood risk, potential water depth, and a host of other factors make up what we call non-regulatory products. Named simply because they aren't the legal definition of a flood insurance hazard zone used by insurance and regulatory agencies, non-regulatory data suites are far better visualization tools. They communicate flood risk by the year or even over the lifetime of a mortgage. These products are as accurate as the engineering models used to make the regulatory data, and can be layered on top of any GIS basemap, including those that showcase local property lines.

Spread the Word

Start by visiting FEMA's non-regulatory product portal, fill in the geographical information, and see what these products can do for your community.

Many flood risk managers wear more than one hat. A gentleman we met in Texas was also the local health inspector who oversaw both wastewater and stormwater projects. These important community leaders are stretched thin, and by making their jobs easier, we directly influence the resiliency of their communities. As water resource and floodplain professionals, we want our engineering analyses to make the successful migration to practical knowledge. In order for that to happen, we need to spread the word that these products are currently being developed and are available at no charge.

While not every product is available for every region, supply will surely rise with demand. Armed with this information, community leaders will be able to spend more energy creating solutions rather than spending so much time simply trying to communicate the problem. The more effective we can make our end-users, the more effective we are as water resource professionals.